What happens when your customers get financial advice from TikTok?

You can’t predict the future, but you can prepare for it

Hi! 👋 Welcome to The Navigator. A newsletter about people, psychology and design for business leaders who want to make meaningful change. I’m Sarah Ronald, and I write this newsletter with the Nile team. If this email was forwarded to you, sign up for it here.

Social media as we know it is recalibrating.

Elon Musk’s Twitter takeover has turned both advertisers and power users off the platform. Meanwhile, layoffs at Meta and other tech giants have sent shockwaves through the economy. What’s happening in the social media space is a microcosm of the widespread uncertainty afflicting our world at large.

I spend a lot of time speaking with financial services and FinTech firms as part of my work at Nile. They're not immune to this uncertainty. Design Director Neil brought a few of them together recently to talk about the future of sustainable finance, and I've invited him to share his insights below in this special edition of the Navigator.

–

Okay, so your customers are getting their financial advice from TikTok now.

People are already congregating online to make decisions about their money. Research shows that 91% of Gen Z report having used social media for investing research. This is more than any other source of information, with 61% reporting Reddit as a trustworthy source. We work with quite a few financial advice firms, and let me tell you: they find this pretty shocking.

What if your next generation of customers don't get their information about you, from you? And what if – as current trends show – they want to interact with you on their terms, in their spaces? This will be pushed to the extreme as online interactions become increasingly immersive.

Trends: follow, or ignore?

So should companies be trying to build in these new spaces, or is it a waste of time?

While Meta pitched its version of the metaverse as the next big thing, it’s been met with scepticism as the maligned company burns through cash and goodwill trying to make it a reality.

None of this is helped by the sour atmosphere in tech right now (and the media’s schadenfreude). Techs’ ‘Nightmare November’ continues with the FTX collapse and widespread layoffs across the industry.

History, however, tells us that revolutionary technology has a habit of fundamentally changing the way we engage with the world and each other (even if it feels like a series of failures at the time).

As the late futurist Roy Amara said:

“We tend to overestimate the effect of a technology in the short run and underestimate the effect in the long run.”

Underestimate changes at your peril

It may be particularly stylish to appear jaded and world-weary about today's trends, but don't let that blind you to the bigger picture. Things are changing, and trends today are useful signals about tomorrow's reality.

Here’s a good example: in 1993, AT&T released its “You Will” ad campaign.

Directed by Fight Club’s David Fincher and narrated by Tom Selleck, the ads presented a vision of the technology of the future. While pie-in-the-sky at the time, the central ideas behind many of the predictions are eerily accurate. Take a look:

Even the ideas that didn’t pan out weren’t completely off the mark. Sure: we don’t fax from the beach, but we do send emails from anywhere. We don’t video call from phonebooths, but we do use video calling – just with a more personal device.

It’s ‘artefacts’ like these which remind me that even when stuff feels silly in the moment, they may still signal a fundamental change in the way we interact digitally. Zuckerberg’s metaverse is a bit like AT&T’s wireless-beach-fax-machine gadget. It’s kind of bad, but it pointed to something real about where technology is going.

When a metaverse eventually does arrive, it won’t look how we expected it to, nor will it come from the company that shouted the loudest about it.

And as for the present day, remember; weird stuff gets made when the old world meets the new. It takes people a while to adjust. Take a minute to read the 1994 Internet Yellow Pages, if you’re ever in any doubt.

So it’s going to be weird. But you can prepare.

Nobody can predict the future. And it’s not worth trying. So instead of asking ‘what’s going to happen?’ for me, a better question is ‘what possibilities can we imagine?’

In practice, this looks like the kind of work we undertook at the Future of Sustainable Finance Event back in October this year.

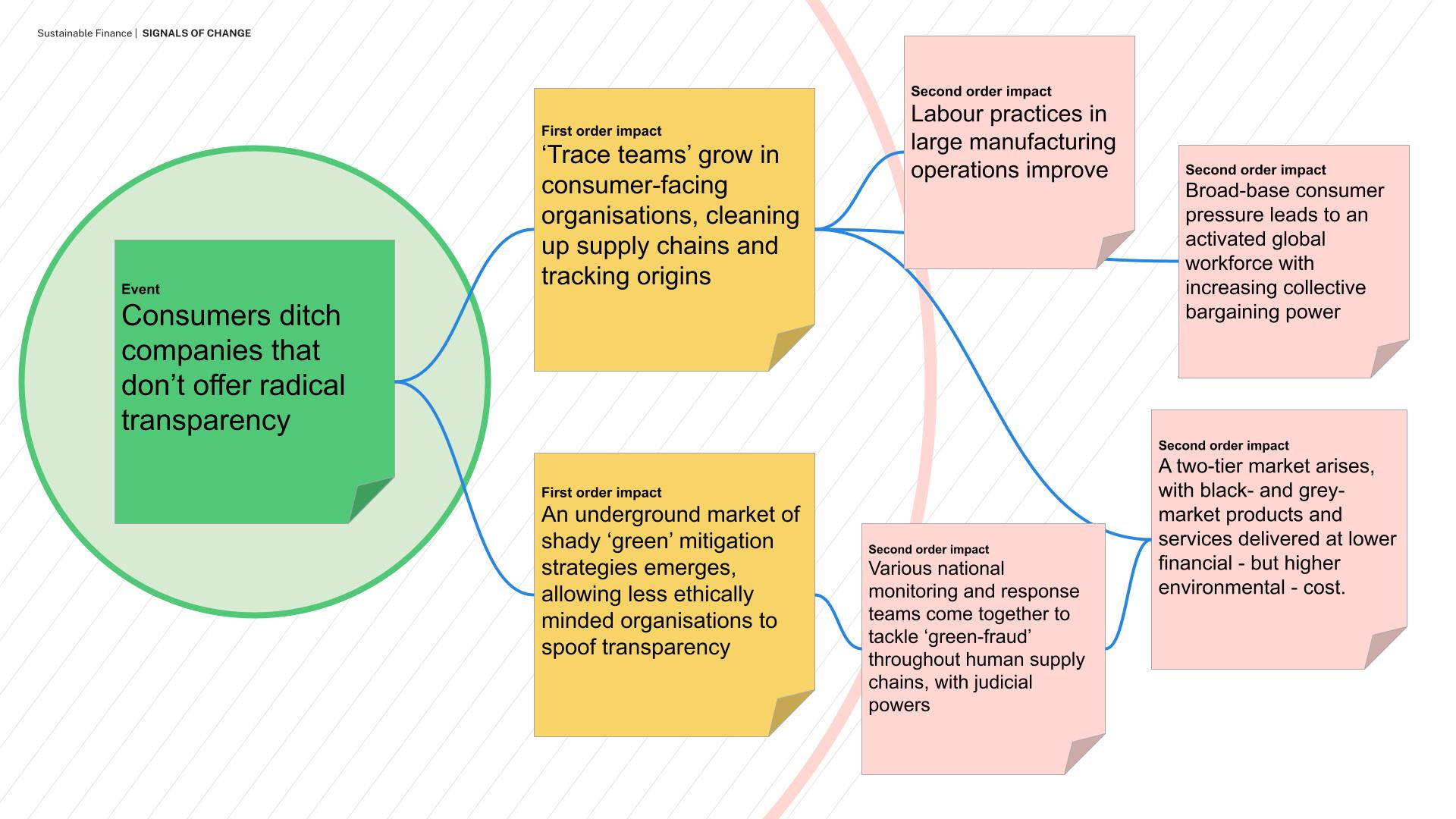

During the workshop, we used one of my favourite foresight tools to help attendees stretch their thinking. Originally developed by Jerome Glenn in 1972, the Futures Wheel helps you to explore the first, second, and third-order consequences of the changes you’re starting to see in the present. It reveals less obvious insights and helps tease out weird or unexpected ways the future could play out.

So perhaps you begin with a question like “What happens if your customers get their financial advice from TikTok?”.

The answers ripple out and make you think about the systemic changes that we’re already starting to see. So it might be TikTok today, but as the wheel expands, future possibilities multiply. Where else will your next generation of customers be getting their information from? Who will they trust, and how might you gain and hold it? And, importantly, what will be your place in that future?

‘Pre-experiencing’ futures like this gives you a birds-eye view of the maze you’re stuck in. Sure, you might not be able to see the way out, but you’re definitely better prepared for the twists and turns to come.

And that’s how we start to navigate our new future. Not through prediction, but through preparation.

One future-orientated action to take today

Make space for foresight conversations: Identify people in your organisation who are open to this way of thinking, and then explore possibilities together.

Even by doing this once a month, you are effectively “pre-experiencing” the future and are better prepared as a result. Start talking today.

Six need-to-know sustainable finance forecasts

Customers will change their identity. Shifting personal values are impacting the way customers see themselves, present themselves and the way they spend.

Customers ditch companies that don’t offer radical transparency. Young people are inheriting a world shaped by Covid, and the shortcomings of older generations. This will have a profound effect on their values and therefore how they approach long term investing, saving and spending.

Environmental impact scores influence all your customer decisions. Climate change impacts are changing the nature of both business and associated customer values and behaviours. In fact, consumers are already willing to pay more for sustainable products or services.

Customers expect perks for using green technologies. As climate change impacts increase and the stakes rise, simply moving away from fossil fuels won’t be enough – we’ll also need to do more with less. This will fundamentally affect all parts of everyday life, like travel, food and of course, money.

Institutions which can find customers in the metaverse leap ahead. Your customers are already congregating online to learn about finance and make investing decisions. This will be pushed to the extreme as online interactions become increasingly immersive.

People and nations are tackling new types of scarcity. The cost of living is skyrocketing around the world with inflation reaching 40-year highs. Combined with unexpectedly accelerated climate impacts, we may be shifting to a new age of scarcity.

Interested in the future of sustainable finance?

Register to attend the second part of our foresight workshop series, digging into the systemic changes we need to make to bring about desirable futures. Join us and the Scottish Financial Enterprise community in Edinburgh for this January event (you’ll need to be an SFE member to attend).

Nile News

We’re making a few improvements to our Circus Lane HQ this month. We need to come up with some names for two new meeting rooms. The team want to name them after either:

a) local pubs (The Vinnie & The Last Word)b) local rivers (Forth & Clyde)

c) local mountains (Scald Law & West Kip)

But I reckon we can do better. Comment with your ideas, and I’ll give you a shout-out if we use yours (and maybe make a small plaque? Idk.)

Notion power-users Tiernan and Callum could barely contain themselves this week after the popular relational database tool launched their new private alpha: Notion AI. The lads have spent most of the week just checking their place in the waitlist, apparently…

Links We Loved

Interested in exploring foresight for your business? Start by gathering the right signals. Our collaborators at IFTF recently published a handy blog post on this - Don't Ask, "Is It Good;" Ask "What Is It Good For?"

Recently I’ve talked to a few clients about contradictions and overlaps in future forecasts; the idea that you can have super advanced provocative futures alongside ‘old fashioned’ ways of doing things. The Voxblock and the Yoto Player are nice signals of this. They’re advanced, internet connected products, but also physical media players with big physical controls, and (almost) no screens. Single function design.

(Also

personally recommends the Yoto player as a great Christmas present for five-year-olds who don't need another Paw Patrol playset)

Finally, a great tweet from speculative designer Tobias Revell, illustrating how we all generally suck at imagining the future. Even Star Trek couldn’t shake off the influence of the status quo: “it’ll be like today, but in space”

We call this Jetsons' bias in Nile - our brains’ propensity to project the status quo into the future, rather than upending it and imagining something new. Neil wrote about this - and how to avoid it - in his blog post on essential habits to cultivate if you want to become a futurist.

Get in touch

Nile is here to help find better solutions for people and businesses. We want to hear from you. Reply directly to this email, get in touch here or reach out on Twitter. And forward this email to someone you think will enjoy it.